corporate tax increase build back better

Make health care child care and housing more affordable. A corporate tax hike wont help us build back better Bidens tax proposal in infrastructure plan would hurt the US against competitors like China.

Are You Facing Difficulty In Managing All Your Digital Marketing Along With Other Business Tasks Digital Marketing Digital Marketing Agency Marketing Goals

Those in the top 1 percent who will make about 885000 or more.

. It is worth noting that the text is not final. Recently the text for the Build Back Better Act BBBA was released by the House Budget Committee. Build Back Better Act BBBA Tax Changes.

The Build Back Better Act was recently narrowed by President Biden. Theyd pay about 55000 more than under current law. This was a lower rate than what was proposed in the Prior House Bill 375 but the effective tax rate under the Prior House Bill was higher due to the increased income tax rates.

The corporate tax increase proposal in the. 5376 the Build Back Better Act. 5376 that includes more than 15 trillion in business international and individual tax increase provisions.

The Build Back Better Agenda will extend the CTC expansion in the ARP providing39 million households and the families of nearly 90 percent of. In a new analysis the Tax Policy Center estimates that the major tax changes in the latest version of President Bidens Build Back Better. The House on November 19 voted 220 to 213 to pass the Build Back Better reconciliation bill HR.

On November 19 th the House passed the Build Back Better BBB tax and spending proposal by a narrow 220 to. Congress should enact the pro-worker international tax reforms in the Build Back Better framework. President Joe Bidens Build Back Better agenda would raise taxes on up to 30 percent of middle-class families despite his campaign promises not to hike taxes on anyone making under 400000 per.

Tax Legislation has left the House for the Senate what changes might be coming. On December 11 the Senate Finance Committee released preliminary text for the revised tax changes in the Senates version of the Build Back Better Act BBBA. The Build Back Better Act contains a large number of tax provisions ranging from an extension of the advance child tax credit to a wide variety of green energy tax incentives and a minimum tax on corporations.

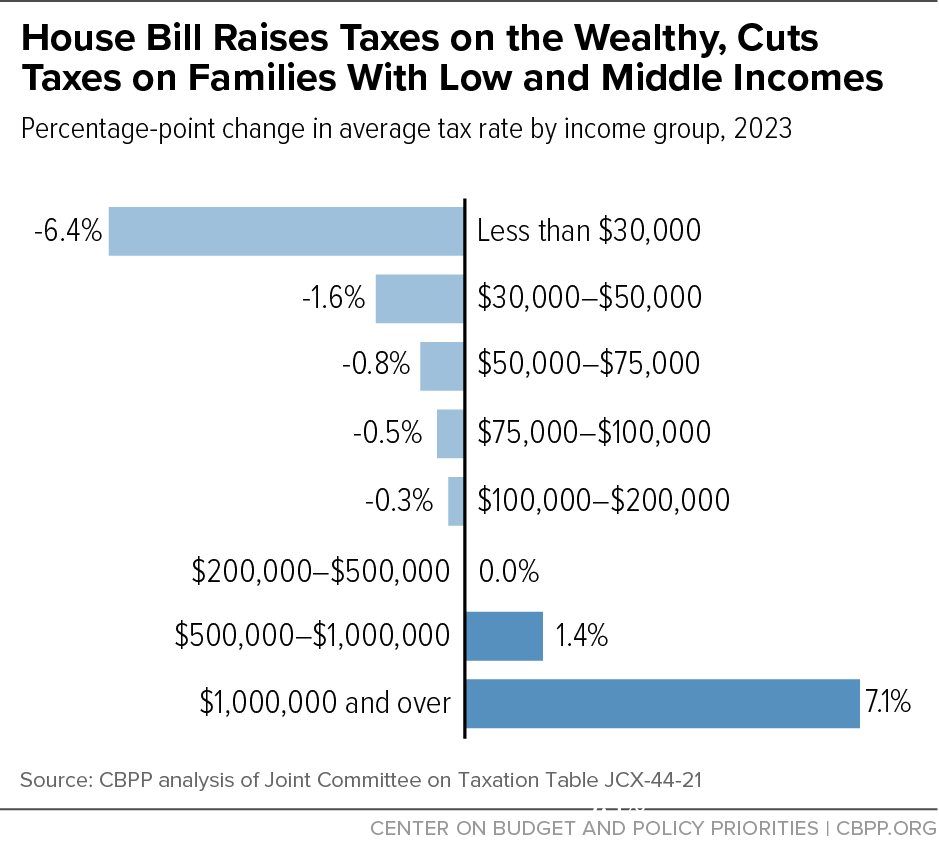

On October 28 2021 House Bill HR. Select Proposals to Increase Taxes from the Build Back Better Act. In a new analysis the Tax Policy Center estimates that the major tax changes in the latest version of President Bidens Build Back Better plan would cut taxes on average for nearly all income groups in 2022.

15 minimum worldwide tax on book income less General Business Credits ie RD and FTCs for TPs with more than 2 BN in annual revenue. Under the TCJA US. The House Build Back Better plan would result in an estimated net revenue increase of about 1 trillion 125000 fewer jobs and on average less after-tax incomes for the top 80 percent of taxpayers by 2031.

This Client Alert discusses the key personal corporate international and energy-related tax provisions of the BBB for various taxpayers. Increase the GILTI tax. Build Back Better Nov.

This rate would be effective for income earned in 2022 which accelerates the rate projected for 2026. The House Rules Committee earlier today released a modified version of HR. 5376 lowered the originally proposed 21 trillion tax increases to 185 trillion.

Included are numerous proposed tax changes that would impact individuals pass-through entities and corporations among other things. Top Individual Marginal Tax Rate of 396. On November 19 2021 the House of Representatives passed the Build Back Better Act the BBB.

Corporations generally are taxed annually at a 105 rate increasing to 13125 in 2026 on the excess of certain global intangible low-tax income. Senate releases Build Back Better Act tax changes as progress slows. And address climate change.

The Build Back Better BBB legislation before the House would raise a reported 185 trillion over ten years to pay for critical investments to reduce child poverty. Raising the corporate tax rate to 265 percent is the most economically harmful provision in the original draft as that change alone would reduce long-run. The House-passed Build Back Better legislation is expected to be revised by the Senate which would then require further action by.

Build Back Better and OECD Corporate Tax Agreement Would Discourage Offshoring Jobs and Profits. The first concrete details on the corporate rate increase emerged on September 15 when The House Ways and Means Committee approved tax increase and tax relief proposals to be sent to The House of Representatives for debate. House of Representatives passed President Bidens priority social legislation called the Build Back Better Act BBBA on 19 November 2021.

The modified version of the bill includes a substantial number of changes to the tax-related provisions of the bill as approved by the House Budget Committee in September 2021. The proposal would increase the top individual 37 rate to 396 for those with taxable incomes of over 400000 and for those filing jointly 450000. Our tax experts discuss these modifications and what you could consider doing now.

The main reason that the latest version of Build Back Better reduces growth by much less than the original draft is because the latest version leaves the corporate tax rate at 21 percent. The BBB will now be sent to the Senate for its consideration. The goals of these proposals in addition to offsetting the cost of spending and tax benefits of the bill were outlined.

Recently the House of Representatives issued new draft legislative text. Tax Implications of the Build Back Better Act. The Build Back Better Bill would have not change the tax rate to be applied to a non-corporate taxpayers GILTI amount.

Latest Warning Sign For Markets A Possible Earnings Recession Months In A Year Stock Index Latest News

10 Steps To Change Careers To Social Impact With Infographic In 2021 Career Change Social Impact Social Enterprise

House Build Back Better Legislation Advances Racial Equity Center On Budget And Policy Priorities

/media/img/posts/2022/02/BBB_figure_5/original.png)

Biden S Biggest Idea On Climate Change Is Remarkably Cheap The Atlantic

How To Use Your Business To Build Your Dream Life Business Tax Business Finance Management Virtual Assistant Business

Pin By Steph Johnson On Politics Letter To The Editor Brookings Low Taxes

Increase Your Tax Refunds Tax Refund Tax Services Tax Help

Build Back Better Framework Democrats

House Build Back Better Legislation Advances Racial Equity Center On Budget And Policy Priorities

The Small Business Accounting Checklist Infographic Small Business Accounting Small Business Finance Bookkeeping Business

Ceos Worried About Corporate Tax Hikes As Dems Push Bills Aimed At Boosting Working Families Work Family No Worries Budgeting

The White House On Twitter White House Staff Frustration White House

What Are The Biggest Small Business Tax Mistakes Small Business Tax Tax Mistakes Business Tax

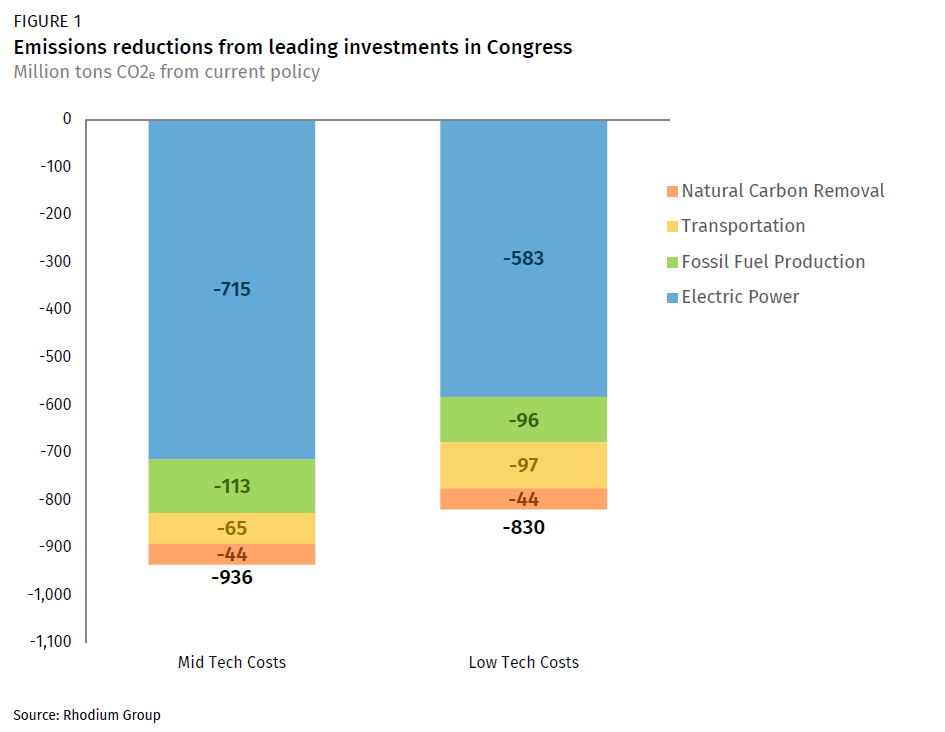

What The Stalled Build Back Better Bill Means For Climate In One Chart The New York Times

What The Stalled Build Back Better Bill Means For Climate In One Chart The New York Times

Pathways To Build Back Better Nearly A Gigaton On The Table In Congress Rhodium Group

Get Ready For Stock Buybacks To Roar Back Marketwatch Dow Jones Industrial Average Bank Of America Bond Market

Logos For Increase Economic Tax Revenue Graphic By Setiawanarief111 Creative Fabrica Tax Revenue Icon Design